Welcome back to Talking Tokens.

We’re building the best place for quick crypto insights, news and in-depth interviews with the best leaders, startups, market players and up-and-coming founders that are changing the industry.

If you haven’t already, subscribe here.

Sponsored Content

Today's newsletter is sponsored by Gravity, the layer-1 blockchain created by Galxe for mass adoption and an omnichain future. Galxe’s onchain distribution platform is integrated across 34+ chains, has 21 million users and 100 million monthly transactions.

To make the user experience as enjoyable as possible, Galxe created Gravity to simplify cross-chain transactions, enhance privacy via ZK proofs, offer rapid transactions, and deliver a user-friendly experience while integrating seamlessly with Galxe’s core products.

For developers, Gravity opens the door to building on the largest onchain distribution platform effortlessly. For users, it promises a smoother, more secure journey through web3. It's not just about being onchain; it’s about being on the right chain every single time.

Ready to elevate your web3 journey? Discover how Galxe and Gravity can propel you forward by clicking here.

Whether you like it or not, a lot of memecoins are scams

The crypto industry is riddled with scams, exploits and mistakes that can cost individuals and businesses tons of money. Especially when the market is up and AI is advancing, users can be at more risk.

“If you were to create a scammer index of bull versus bear market, it would currently be pointing more toward bull than bear,” Coinbase Chief Security Officer Philip Martin said on Talking Tokens. “We see the same thing, activity increases and decreases with the health of the state of the market overall.”

Earlier this month, the FBI put out a Cryptocurrency Fraud Report that found Americans lost billions in crypto-related scams last year. Globally, in the past year over $1.6 billion was lost to DeFi scams, hacks and exploits and only $107 million of that amount was recovered, the De.Fi Rekt database showed.

“We currently see a lot of scammers paying attention to crypto,” Martin said.

Scams don’t have to derive from a shadowy character in the night, or someone exploiting a blockchain for hundreds of millions of dollars, but could also be found in a category that is extremely popular this market cycle: memecoins.

When asked if Martin viewed memecoins that are rug-pulls as a scam, he nodded.

They are a “confidence scam,” he added. “The person or people who are building a meme token and intend on rug-pulling it are trying to build confidence and create investment before they run away with the money.”

In general, there are hundreds of thousands of memecoins in circulation today. Majority last less than a day, if even a few hours. While there are some out there that have succeeded to gain market share, most don’t.

“I don’t see it any different than any other type of scam,” Martin said. “The mechanics are obviously different, but mechanics of scams change.”

Check out the next section for more details and the full episode.

The latest Talking Tokens podcast 🎙️

For this week’s Thursday episode, I sat down with Coinbase Chief Security Officer Philip Martin.

We talk about security in crypto, the most common – and uncommon – scams and how to avoid them, what Coinbase is doing to stay safe and more.

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 10AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Monitoring blockchains

Looking at some of the biggest developments onchain.

Sei blockchain passed $200 million in TVL

LayerZero activity spikes 433% after its second airdrop announcement

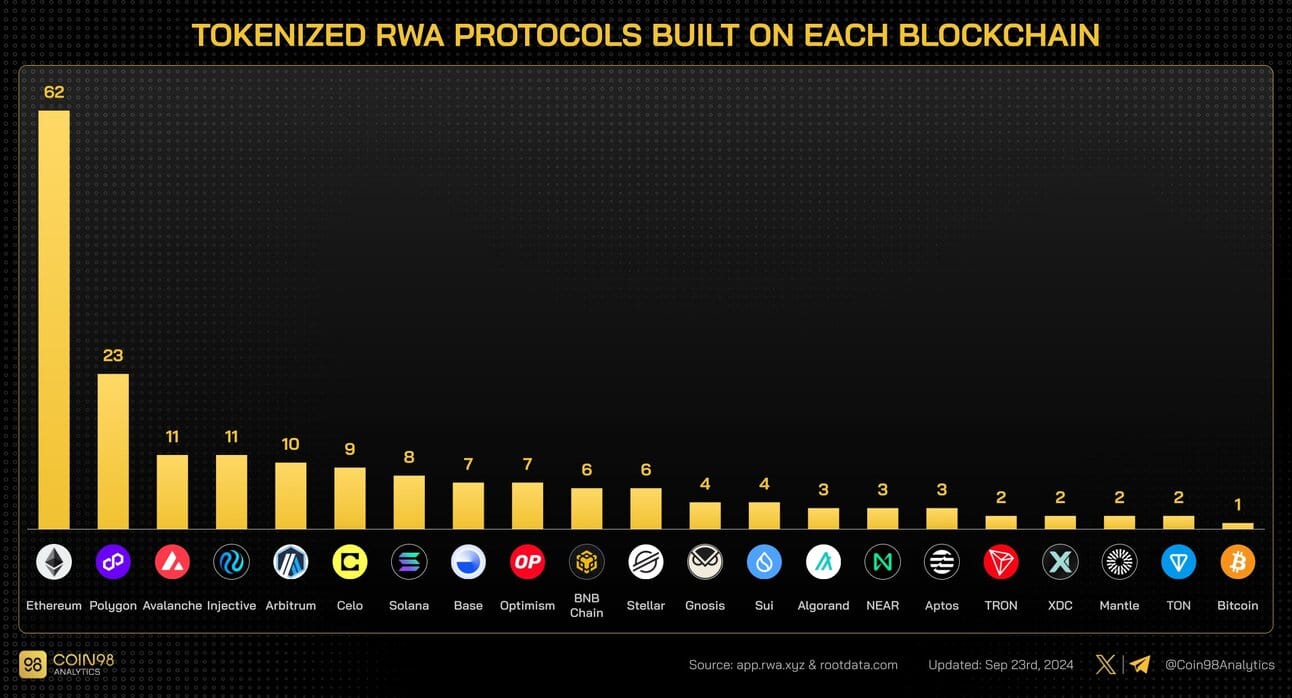

Tokenized RWAs are seeing the most protocols being built on Ethereum, Polygon, Avalanche and Injective, according to Coin98 Analytics (chart below)

Taking on the tokens

The total crypto market cap is up about 1% in the past 24-hours to $2.26 trillion. It rose 4.1% over a 7-day period.

As for the largest cryptocurrencies by market cap…

Token | Price | 24h % | 7-day % |

|---|---|---|---|

Bitcoin (BTC) | $ 64,460 | + 1.02 | + 2.24 |

Ethereum (ETH) | $ 2,629 | + 0.14 | + 7.52 |

BNB (BNB) | $ 594.13 | - 0.39 | + 5.32 |

Solana (SOL) | $ 152.87 | + 1.50 | + 8.69 |

These metrics were taken prior to publication on Thursday morning EST.

Money and people moves

Latest updates on crypto startups that secured funding and industry players who are starting something new.

ICYMI: Former Alameda Research CEO Caroline Ellison was sentenced to 2 years in prison

Initia raises $14 million in a Series A round to build its layer-1 network and “interwoven optimistic rollups”

A16z makes first 'DeSci' investment in decentralized biobank platform AminoChain (The Block)

Talking points for the road

Here’s some headlines and topics that you can talk about at your next dinner party, crypto event or on a first date to look smart (results may vary.)

PayPal to allow US business accounts to buy and transfer crypto (The Block)

Kamala Harris says she will support crypto: Here are 3 steps that would show she’s serious (Fortune)

Terraform Labs may close products, services in bankruptcy wind-down (Cointelegraph)

Stablecoins Will Drive Institutional Adoption in Asia: Chainalysis CEO (CoinDesk)

Get involved and share the newsletter. The more you share, the higher your ranking.

Refer 25 people and get my customized media guide.

Refer 50 people for a chance at a 1:1 meeting with me to dive into best practices when engaging with the media.

Was this email forwarded to you? Subscribe here.

If you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.