Welcome back to Talking Tokens.

We’re building the best place for quick crypto insights, news and in-depth interviews with the best leaders, startups, market players and up-and-coming founders that are changing the industry.

Housekeeping notes: Please make sure you move this email to your primary inbox and add our email to your contact list.

And If you haven’t already, subscribe here.

The ‘coast is clear’ for crypto VCs to deploy more capital

As the crypto venture landscape shows sign of revival after the recent bear market, some investors like CoinFund’s CIO Alex Felix believe that the future is still bright for the market.

According to PitchBook data, over $3.88 billion in capital has been raised across the crypto and blockchain sector since the beginning of 2024.

While it’s unlikely for the crypto VC landscape to have a “sharp spike up” in capital deployment similar to the 2021 and 2022 highs, Felix expects that 2025 will have more meaningful amounts of checks being written.

But today’s market is hot as early stage venture deals are flowing at a faster pace than previous quarters, Felix said. The crypto VC market will “continue to see more activity than last year,” as the “coast is clear” for cautious venture investors to dive back in, Felix said on Talking Tokens podcast. “There’s not a lot of reason to be on the sidelines,” he added.

Check out the next section for more details and the full episode.

The latest Talking Tokens podcast 🎙️

For this week’s Thursday episode, I sat down with Alex Felix, managing partner and chief investment officer at CoinFund. Listen to the podcast on Spotify, or Apple Podcasts.

We discuss his entry into the crypto space from a TradFi background, how competitive the investor landscape is today, what projects he’s most interested in, Telegram’s deeper dive into the crypto space and the crypto venture capital market heating up.

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 10AM EST every Tuesday and Thursday.

Make sure to subscribe and feel free to leave a review and share your thoughts!

Monitoring blockchains

Looking at some of the biggest developments onchain.

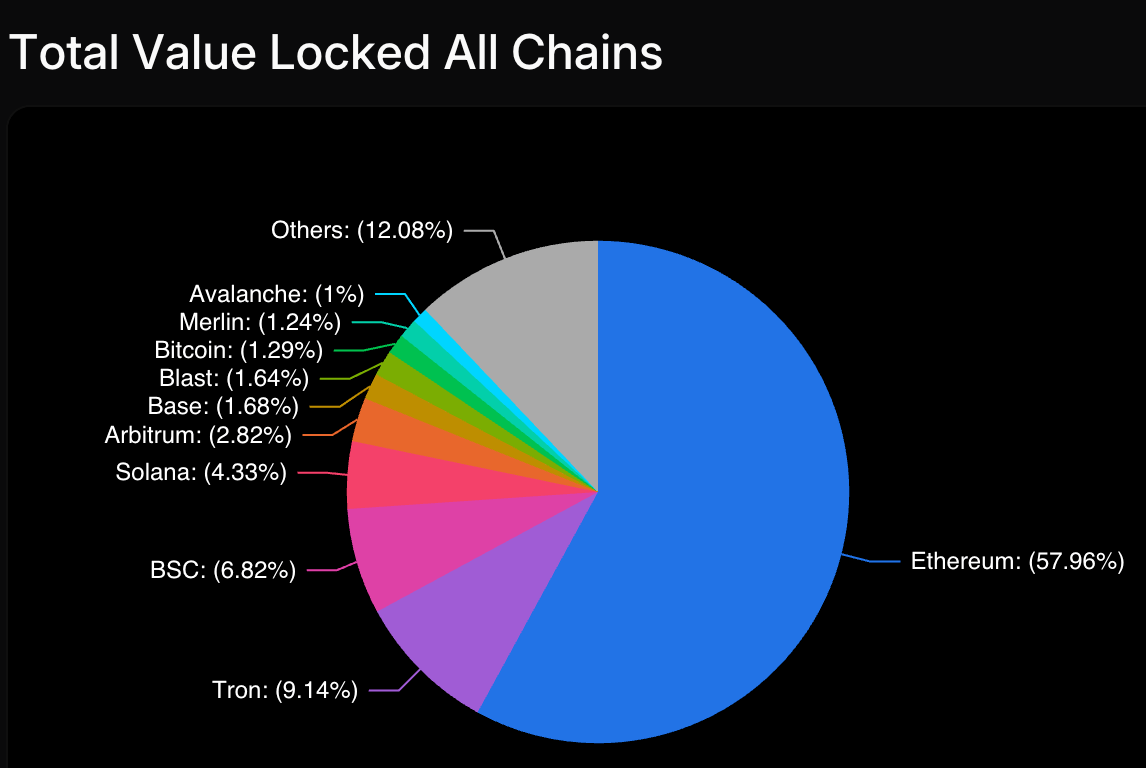

The total value locked (TVL) across the whole crypto ecosystem is around $98.78 billion, according to DefiLlama data. While that metric is down from all-time highs in late 2021, there’s recent growth as the top 10 blockchains by TVL are up over a 7-day period.

It’s no surprise that Ethereum is dominant, but check out where the rest of TVL is flowing across 280 chains below:

Taking on the tokens

The total crypto market cap decreased 1.3% in the past 24-hours to $2.26 trillion. It is up 2.72% over a 7-day period.

As for the largest coins by market cap…

Cryptocurrency | Price | 24h % | 7-day % |

|---|---|---|---|

Bitcoin (BTC) | $61,107 | -1.94% | +4.35% |

Ethereum (ETH) | $2,980 | -0.47% | -0.31% |

BNB (BNB) | $594.95 | +1.66% | +6.43% |

Solana (SOL) | $142.42 | -2.25% | +3.56% |

These metrics were taken at 7:45 AM EST on Thursday.

Other numbers we’re eyeing…

$1.8 billion. That’s the amount of spot Bitcoin ETF holdings that Susquehanna International Group owns, according to a recent SEC filing. About 60%, or $1.092B, of its holding is allocated with Grayscale.

Money and people moves

Latest updates on crypto startups that secured funding and industry players who are starting something new.

Botanix Labs raised $11.5M to build the Spiderchain, an EVM layer-2 blockchain on Bitcoin

Talking points for the road

Here’s some headlines and topics that you can talk about at your next dinner party, crypto event or on a first date to look smart (results may vary.)

SEC files final response in Ripple XRP case (Cointelegraph)

Get involved and share the newsletter. The more you share, the higher your ranking.

Refer 25 people and get my customized media guide.

Refer 50 people for a chance at a 1:1 meeting with me to dive into best practices when engaging with the media.

Was this email forwarded to you? Subscribe here.

If you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.