Welcome back to Talking Tokens.

We’re building the best place for quick crypto insights, news and in-depth interviews with the best leaders, startups, market players and up-and-coming founders that are changing the industry.

If you haven’t already, subscribe here.

Today's newsletter is sponsored by Gravity, the layer-1 blockchain created by Galxe for mass adoption and an omnichain future. Galxe’s onchain distribution platform is integrated across 34+ chains, has 21 million users and 100 million monthly transactions.

To make the user experience as enjoyable as possible, Galxe created Gravity to simplify cross-chain transactions, enhance privacy via ZK proofs, offer rapid transactions, and deliver a user-friendly experience while integrating seamlessly with Galxe’s core products.

For developers, Gravity opens the door to building on the largest onchain distribution platform effortlessly. For users, it promises a smoother, more secure journey through web3. It's not just about being onchain; it’s about being on the right chain every single time.

Ready to elevate your web3 journey? Discover how Galxe and Gravity can propel you forward by clicking here.

Building crypto-native money

It typically takes startups time to gain meaningful traction, especially in the web3 industry where new projects seem to be popping up every day.

But Ethena Labs, the entity behind the Ethena Protocol, its ENA token and synthetic stablecoin dollar USDe, had its token generation event (TGE) earlier this year and has seen substantial growth since.

“Ethena is reasonably big at about $3.5 billion [market cap] but there is scope for it to get quite a lot bigger,” Guy Young, Ethena Labs founder said on Talking Tokens podcast.

(Listen to the episode on Spotify, Apple Podcasts or YouTube.)

USDe currently has a yield of over 17%, Young shared. At the time of recording, USDe had a market cap over $3.5 billion and 24-hour volume of about $44 million since launching in mid-February.

The company is backed by Dragonfly, Binance Labs, OKX Ventures and Galaxy Ventures, among others. And earlier this year its total value locked surpassed $2 billion. It is currently expanding its roadmap and token capabilities after its token launch in early April.

“For us it’s all about building financial infrastructure around USDe,” Young said. “Crypto-native money is the guiding vision behind what we’re doing. It sounds simple but it’s actually a pretty important thing to work toward.”

When it comes to thinking about what type of product can appeal to 100 million people, Young thinks it’ll be something as simple as “holding a dollar in a wallet and getting yield and sending it to your friends or spending it.”

“The basic piece for us is once you produce a dollar that has structurally higher return, which is what Ethena’s USDe is producing right now, that’s actually kind of enough – [and] if you can start to get that in the hands of people all over the world,” Young said. “That’s something most people want is to hold a dollar and get yield.”

Check out the next section for more details and the full episode.

The latest Talking Tokens podcast 🎙️

For this week’s Thursday episode, I interviewed Guy Young, the founder of Ethena Labs.

We discuss how Ethena Labs came to be, the launch of its USDe stablecoin and $ENA token as well as its near-term roadmap and tokenomics for both digital assets.

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 10AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Monitoring blockchains

Looking at some of the biggest developments onchain.

Solana launched “Blinks” and “Actions” so users can transact with crypto across websites and applications

Worldcoin partners with Alchemy to provide its infrastructure for its anticipated World Chain

Solo Leveling is building on Avalanche with OTHERWORLD to bring fans into blockchain experiences

Taking on the tokens

The total crypto market cap lowered less than 1% in the past 24-hours to $2.26 trillion. It is down 6.6% over a 7-day period.

As for the largest cryptocurrencies by market cap…

Token | Price | 24h % | 7-day % |

|---|---|---|---|

Bitcoin (BTC) | $ 61,112 | - 0.42 % | - 7.82 % |

Ethereum (ETH) | $ 3,395 | + 0.53 % | - 6.08 % |

BNB (BNB) | $ 572.75 | - 0.37 % | - 5.63 % |

Solana (SOL) | $ 138.81 | + 1.08 % | - 0.92 % |

These metrics were taken at prior to publication Thursday morning.

Other numbers we’re eyeing…

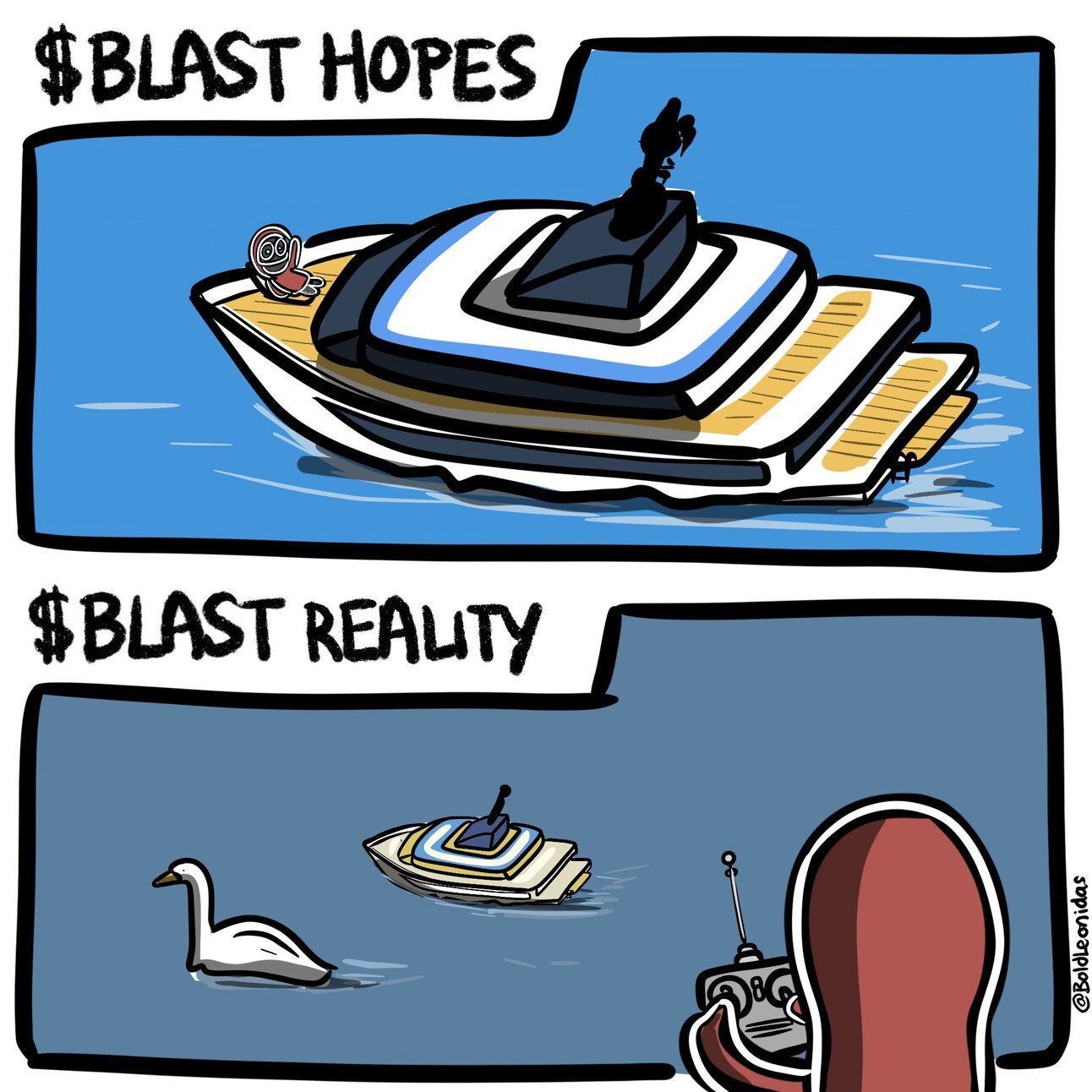

$3 billion - that’s the value Blast’s token launched at after it provided almost one-fifth of its supply to early adopters who staked ether on its chain. But not everyone is happy about it and memes are circulating on “Crypto Twitter.”

Money and people moves

Latest updates on crypto startups that secured funding and industry players who are starting something new.

ORA Protocol raised $20M to develop infra for open and accessible decentralized AI on Ethereum

Web3 accelerator Colosseum closed a $60M fund to support founders building on Solana

Crypto Market Maker GSR Names Rosenblum, Song as Co-CEOs (Bloomberg)

Former CEO of crypto project Hydrogen sentenced to over three years for securities fraud (The Block)

Crypto infra firm Conduit raised $37M in a round co-led by Paradigm, Haun Ventures

Talking points for the road

Here’s some headlines and topics that you can talk about at your next dinner party, crypto event or on a first date to look smart (results may vary.)

Ava Labs bets web3 will explode in $20 billion K-pop market (DL News)

Why Spot Ethereum ETPs Will Attract Billions (Bitwise Weekly CIO Memo)

Memecoins flood Dexscreener’s newly released Pump.fun competitor Moonshot (The Block)

Animoca Looks to Go Public in Hong Kong or Middle East in 2025: Report (CoinDesk)

Get involved and share the newsletter. The more you share, the higher your ranking.

Refer 25 people and get my customized media guide.

Refer 50 people for a chance at a 1:1 meeting with me to dive into best practices when engaging with the media.

Was this email forwarded to you? Subscribe here.

If you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.