Welcome back to Talking Tokens. This newsletter is being written from thousands of feet in the sky as I fly back home from Token2049 in Singapore. I was also at Korea Blockchain Week in Seoul last week, so if you couldn’t make it to the event, we’ve got you covered with the panels I moderated.

Starting with my American Bitcoin fireside chat featuring Donald Trump Jr. dialing in from a cabin in the Yukon valley. That’s a sentence I never knew I’d type.

Check it out below.

Was this forwarded to you? subscribe here.

Scaling Stablecoin Infra with Fireblocks

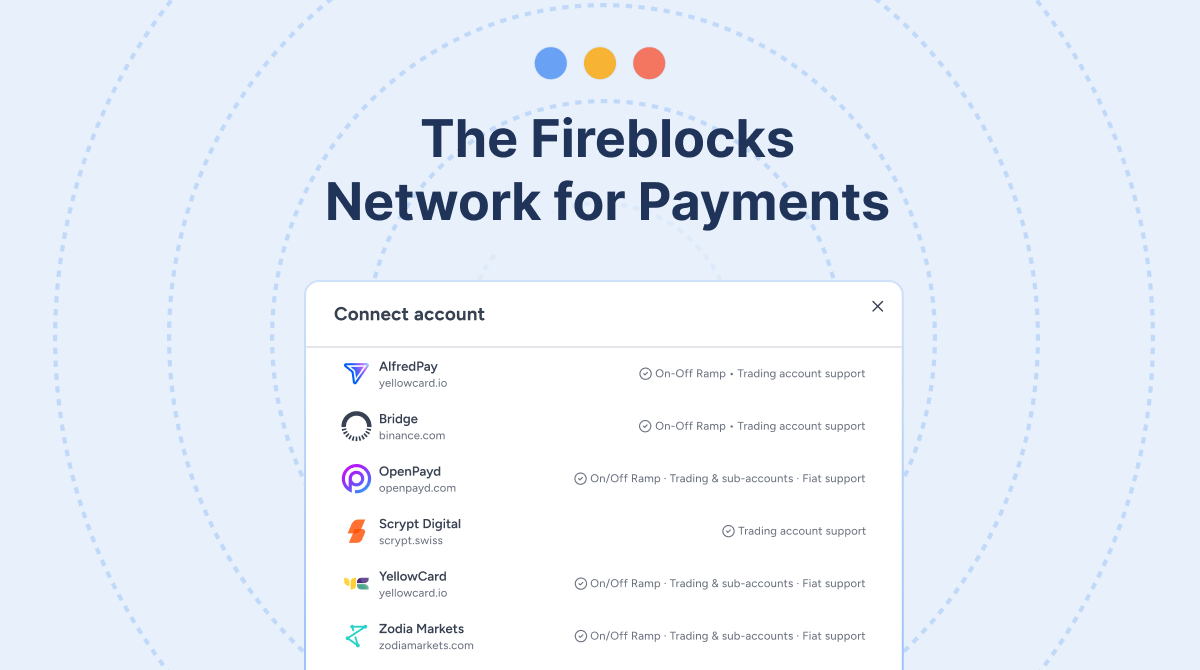

This episode of Talking Tokens is brought to you by Fireblocks — the stablecoin infrastructure of choice for top global businesses, from Visa and Worldpay to Bridge and Revolut.

With over $100 billion in monthly stablecoin volume, Fireblocks powers stablecoin strategies at scale with infrastructure that enables PSPs, fintechs, remitters and banks to issue, move, hold, and manage stablecoins. And it’s all done securely, at scale, and with built-in compliance.

With Fireblocks, you get complete control to build your own stablecoin orchestration layer, create payment accounts, manage liquidity, and access on- and off-ramp into over 60 currencies — making it easier to build, scale, and expand your stablecoin business globally.

Learn more at fireblocks.com.

The latest Talking Tokens podcast 🎙️

For today’s Talking Tokens episode, we’re sharing my Korea Blockchain Week panel with American Bitcoin’s Donald Trump Jr., Mike Ho and Matt Prusak.

We dive into their takes on why Bitcoin is the ultimate scarce asset and how they compare it to gold, underlining Bitcoin’s fixed supply and growing institutional adoption. The team shares their business model behind American Bitcoin, blending mining and treasury operations to maximize Bitcoin accumulation and shareholder value. They explore how institutions are finally embracing Bitcoin amid evolving regulatory clarity and rising market maturity, including major moves in the US.

Don Jr. reflects on Bitcoin’s power for financial democratization and global influence. The conversation dives into the future opportunities and long-term strategies for crypto adoption across global markets like South Korea, and how Bitcoin is poised for a financial revolution beyond simple investment.

Timestamps:

00:01 – Introduction and host welcome

01:39 – Bitcoin as the world’s one true scarce asset vs gold

04:15 – Ownership and dormant supply insights

05:50 – American Bitcoin’s business model: combining mining and treasury

08:10 – Tools to increase Bitcoin ownership per share

10:00 – Institutional adoption trends and current owners

12:10 – Bitcoin regulatory advances and US policy impact

14:00 – Introduction of Donald Trump Jr. joining remotely

15:40 – Bitcoin as a global borderless value transfer and prosperity tool

18:20 – Democratization of finance with Bitcoin and crypto

21:30 – Bitcoin diplomacy and influence globally

24:00 – Market differences: US, South Korea, and global opportunity

26:00 – Future strategies for Bitcoin and crypto adoption

28:20 – Closing reflections from all guests

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 8AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Money and people moves

Ethereum Foundation adds Igor Barinov as coordinator of Privacy and moves Andy Guzman to coordinator of the Privacy Stewards of Ethereum (PSE) team to help expand privacy on the blockchain

Meanwhile Sam Richards of the Ethereum Foundation and PSE steps away after six years

Susquehanna crypto CEO departs to lead Avalanche Treasury Co., launching with $675M+ business transaction, approximately $460M in treasury assets

Bitcoin lending platform Lava raises $17.5 million, launches new yield product (The Block)

Sam Callahan joins OranjeBTC as director of bitcoin strategy and research

Get involved and share the newsletter.

The more you refer, the more perks you could get!

And if you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.