Welcome back to Talking Tokens.

Was this forwarded to you? subscribe here.

Scaling Stablecoin Infra with Fireblocks

This episode of Talking Tokens is brought to you by Fireblocks — the stablecoin infrastructure of choice for top global businesses, from Visa and Worldpay to Bridge and Revolut.

With over $100 billion in monthly stablecoin volume, Fireblocks powers stablecoin strategies at scale with infrastructure that enables PSPs, fintechs, remitters and banks to issue, move, hold, and manage stablecoins. And it’s all done securely, at scale, and with built-in compliance.

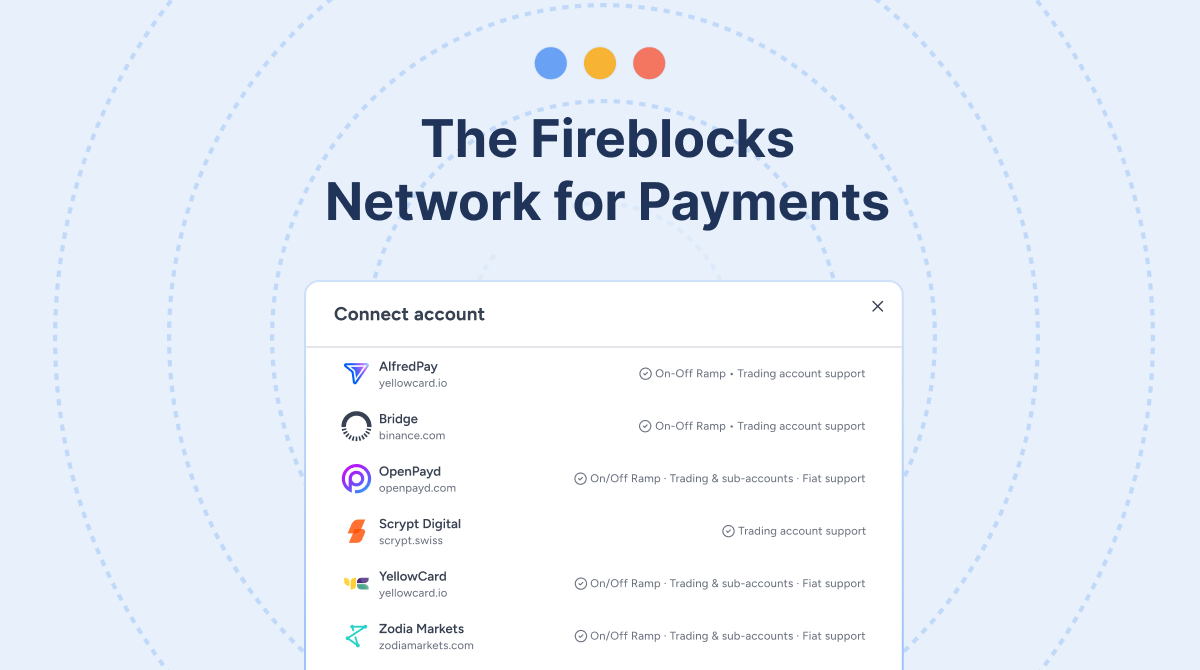

With Fireblocks, you get complete control to build your own stablecoin orchestration layer, create payment accounts, manage liquidity, and access on- and off-ramp into over 60 currencies — making it easier to build, scale, and expand your stablecoin business globally.

Learn more at fireblocks.com.

The latest Talking Tokens podcast 🎙️

For today’s Talking Tokens episode, I sat down with Hong Kim, co-founder and CTO of Bitwise Asset Management, recorded live at Token2049 in Singapore.

Hong shares his journey from an early interest in Ethereum and product development to building one of the first institutional crypto asset management firms. The conversation covers the evolution of crypto asset management from niche and speculative to a maturing industry gaining recognition among major institutions. Hong explains Bitwise’s product strategy focusing on ETFs, staking, and innovative yield strategies aimed at mainstream adoption.

He also sheds light on reaching global markets, evolving regulatory dynamics, and the vision for tokenized securities and on-chain asset management. Hong closes with timeless advice on maintaining perspective amidst crypto’s cycles and the profound growth still ahead.

TIMESTAMPS:

00:00 – Intro: Hong Kim at Token2049 Singapore

00:40 – Founding Bitwise in 2017 & spotting the early asset management gap

02:01 – How crypto evolved from “meme stock” to institutional asset class

03:13 – Why Bitcoin ETFs mirror gold’s adoption curve

05:11 – Building credibility & product-market fit in crypto asset management

06:32 – Inside Bitwise’s top-performing products: BTC, ETH & crypto equities

07:33 – Circle’s IPO & why stablecoins changed investor sentiment

09:06 – Global expansion & how Bitwise educates financial advisors

10:46 – Consistency through bear markets: why trust is built over time

11:52 – Hong’s perspective on Korea’s unique retail trading culture

13:50 – Stablecoins, regulation & Asia’s growing institutional appetite

15:25 – The future of tokenization & asset management onchain

17:21 – Bitwise’s staking, DeFi & yield strategies for institutions

20:01 – The SEC, tokenized equities & removing regulatory roadblocks

22:32 – What tokenized Wall Street could look like in 3 years

24:45 – Final advice from Hong Kim

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 8AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Money and people moves

YZi Labs announces $1B Builder Fund focused on founders in the BNB Ecosystem

Plume is acquiring Dinero to expand its institutional infra for ETH, SOL and BTC

Meanwhile, a bitcoin life insurance firm, raised $82M in new funding

Succinct adds Brian Trunzo as chief growth officer

Benji Taylor joins Coinbase as head of design at Base

Tarik Bell left Uniswap after leading its engineering team for 3.5 years

Get involved and share the newsletter.

The more you refer, the more perks you could get!

And if you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.