Welcome back to Talking Tokens.

Was this forwarded to you? subscribe here.

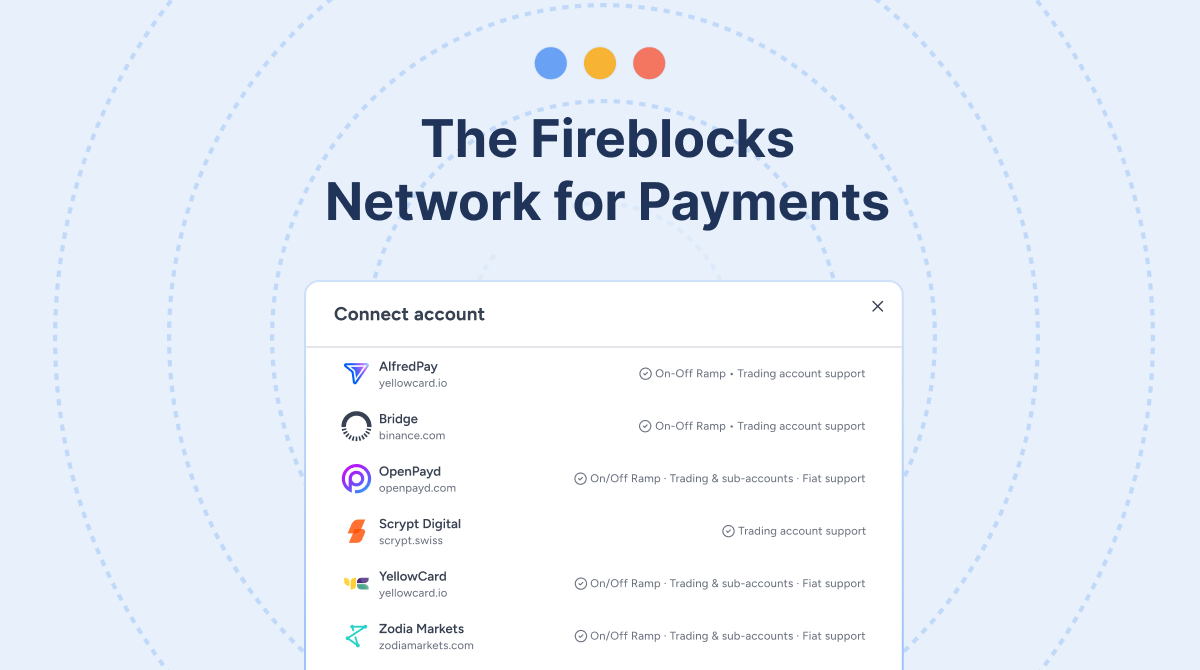

Scaling Stablecoin Infra with Fireblocks

This episode of Talking Tokens is brought to you by Fireblocks — the stablecoin infrastructure of choice for top global businesses, from Visa and Worldpay to Bridge and Revolut.

With over $100 billion in monthly stablecoin volume, Fireblocks powers stablecoin strategies at scale with infrastructure that enables PSPs, fintechs, remitters and banks to issue, move, hold, and manage stablecoins. And it’s all done securely, at scale, and with built-in compliance.

With Fireblocks, you get complete control to build your own stablecoin orchestration layer, create payment accounts, manage liquidity, and access on- and off-ramp into over 60 currencies — making it easier to build, scale, and expand your stablecoin business globally.

Learn more at fireblocks.com.

The latest Talking Tokens podcast 🎙️

For today’s Talking Tokens episode, we’re sharing the last interview I did on stage at Korea Blockchain Week. (It took us a little while to get the footage back, sorry it was so delayed!)

I sat down with Diogo Mónica, general partner at Haun Ventures, executive chairman and co-founder of Anchorage Digital, and chairman of the NEAR Foundation.

Diogo shares how these roles intersect from managing billions in digital assets at Anchorage to backing early-stage founders at Haun Ventures and helping NEAR drive developer adoption. We discuss the next era of crypto use cases beyond trading, including stablecoins, tokenized equities, and “generative finance,” where AI creates tailored financial products in seconds.

He explains how stablecoins reached global product-market fit in the Global South, why the Genius Act mattered, and how tokenization can reshape capital markets through onchain IPOs. Diogo also shares his view on regulation, crypto neobanks, and the intersection of AI and DeFi.

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 8AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Money and people moves

Late-stage payments company Modern Treasury acquires stablecoin startup Beam for $40 million (Fortune)

Crypto Prime Broker FalconX to Acquire ETP Issuer 21shares (Bloomberg)

Aave DAO proposes $50 million annual token buyback program funded by protocol revenue (The Block)

Kadena organization announces its “ceasing all business activity and active maintenance of the Kadena blockchain immediately”

Kraken Revenue More Than Doubled in Q3 as Company Preps for Possible IPO (CoinDesk)

Get involved and share the newsletter.

The more you refer, the more perks you could get!

And if you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.