Welcome back to Talking Tokens.

We’re building the perfect place for quick crypto insights, news and in-depth interviews with the best leaders, startups, market players and up-and-coming founders that are changing the industry.

If you haven’t already, subscribe here.

Magic Eden’s Bitcoin bet is paying off as volume skyrockets

The NFT market may be far from all-time highs, but that isn’t stopping marketplaces from shipping out new products and scaling.

“Most of the last year was a pretty tough market,” Magic Eden co-founder Zhuoxun ‘Zedd’ Yin, said on Talking Tokens. The NFT marketplace spent a lot of time doing “dirty work” and adding infrastructure to help it onboard more blockchains, more quickly.

“In crypto you need to have some level of flexibility in your roadmap because you just never know what is around the corner,” Yin said.

And that nimbleness has paid off.

Magic Eden has been the top NFT marketplace for the past 3 months, bringing in about $1.7 billion in volume, making up about a third of the marketshare, according to Tiexo data. While that feat is impressive, Yin noted it was a “really tough grind to get us into this position.”

The marketplace has added support for the Bitcoin ecosystem, most notably through NFT-like Ordinals in early 2023 and Runes, a new type of fungible token on Bitcoin. Ten days ago, Magic Eden launched its beta platform for Runes and since then it did $56 million in volume, the team told Talking Tokens exclusively. The platform lets users swap bitcoin to buy Runes and Ordinals through their Magic Eden wallets.

At the time of our podcast recording, Yin shared Magic Eden’s Runes platform volume was $12 million, so it increased 366% in less than a week, signaling extremely strong demand for Runes infrastructure through the marketplace.

Check out the next section for more details and the full episode.

The latest Talking Tokens podcast 🎙️

For this week’s Thursday episode, I sat down with Magic Eden co-founder Zhuoxun ‘Zedd’ Yin. Listen to the podcast here on Spotify, Apple Podcasts or YouTube, where we dive into:

Magic Eden’s strategy

Bitcoin Ordinals and the launch of its Runes platform

Building out an NFT marketplace in a competitive space

How to manage risk in a volatile market

The future of NFTs and when the next bull run will be

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 12PM EST every Tuesday and Thursday. Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts!

Monitoring blockchains

Looking at some of the biggest developments onchain.

In April, the number of active addresses on Solana fell 6.7% on the month to 36.2M, aside from March, it’s the highest level since June 2022

ICYMI: Avalanche has about 200M $BTC.b liquidity on C-Chain, X user CaesarJulius0 shared

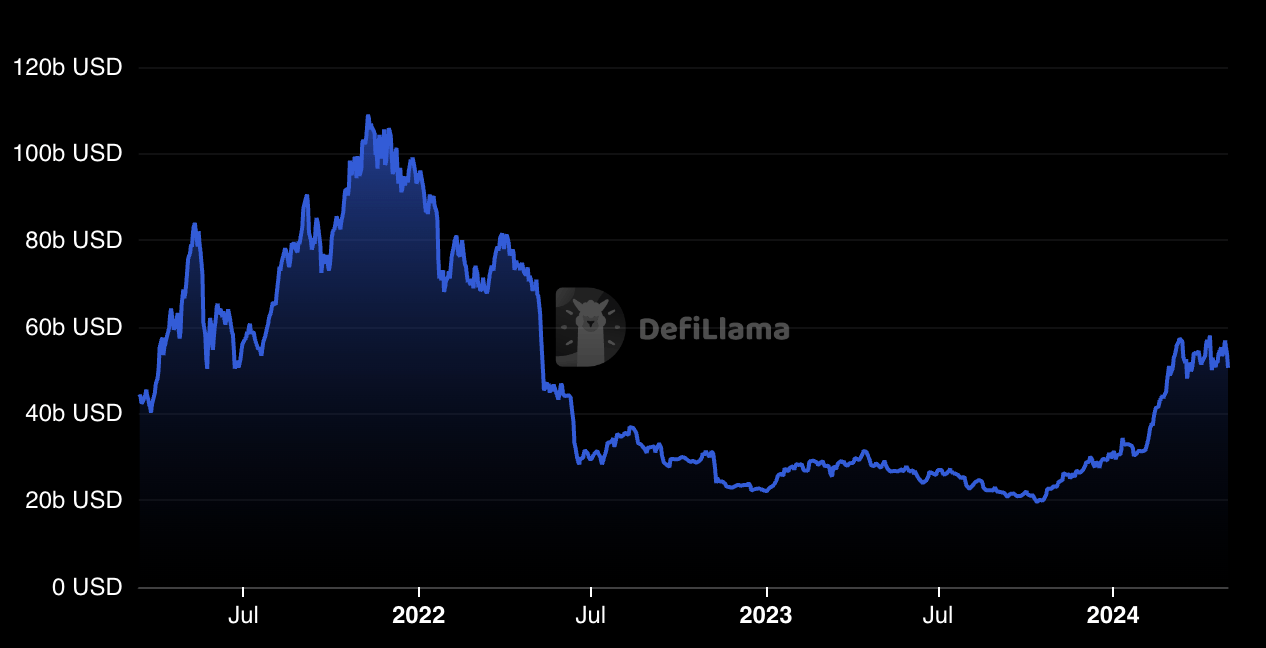

Even with prices down, Ethereum DeFi total value locked (TVL) has been seesawing around $50.5B, the highest range since May 2022.

Taking on the tokens

The total crypto market cap increased 1.86% in the past 24-hours to $2.2T. It is down 6.8% over a 7-day period.

As for the largest coins by market cap…

Cryptocurrency | Price | 24h % | 7-day % |

|---|---|---|---|

Bitcoin (BTC) | $58,660 | +1.32% | -8.14% |

Ethereum (ETH) | $2,996 | +2.87% | -3.70% |

BNB (BNB) | $562.43 | +2.14% | -7.38% |

Solana (SOL) | $138.66 | +12.8% | -4.26% |

These metrics are accurate as of 8:00 AM EST.

Other numbers we’re eyeing…

The U.S. spot bitcoin ETFs were a huge hit after launching earlier this year, prompting billions in inflows. In April, the market saw $343.5M in withdrawals, marking the first monthly net outflows since trading began in January.

Money and people moves

Latest updates on crypto startups that secured funding and industry players who are starting something new.

Talking points for the road

Here’s some headlines and topics that you can talk about at your next dinner party, crypto event or on a first date to look smart (results may vary.)

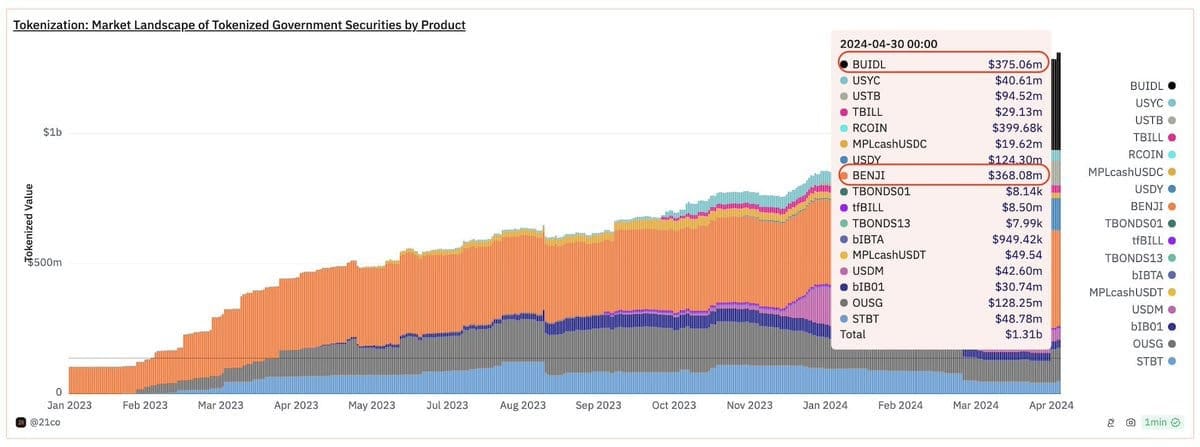

Speaking of BlackRock…its BUIDL tokenized offering is the largest tokenized treasury fund at $375M, making up almost 30% of the $1.3B tokenized Treasury market in about six weeks (CoinDesk)

Get involved and share the newsletter. The more you share, the higher your ranking.

Refer 25 people and get my customized media guide.

Refer 50 people for a chance at a 1:1 meeting with me to dive into best practices when engaging with the media.

Was this email forwarded to you? Subscribe here.

If you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.