Welcome back to Talking Tokens.

Was this forwarded to you? subscribe here.

The latest Talking Tokens podcast 🎙️

For today’s Talking Tokens episode, I sat down with Maja Vujinovic, CEO and co-founder of Digital Assets FG Nexus. Maja unpacks FG Nexus’s recent partnership with Securitize to put both its common and dividend-paying preferred shares fully on Ethereum, making it the first time a Nasdaq-listed company can offer truly onchain equity with programmable features.

The conversation covers what “native tokenization” really means, contrasts it with traditional “wrapped” assets, and explores how direct onchain issuance lowers settlement times, improves transparency, and radically rethinks corporate finance. Maja shares lessons from building in regulated markets, the technology and governance challenges in real-world asset tokenization, and how programmable shares could rewire global investor access and governance.

Sponsored by Securitize, the proven leader in tokenized funds, equities, and private markets. Discover more at securitize.io.

Timestamps:

00:00 – Intro

01:02 – What tokenization really means and how it works in practice

02:16 – Inside FG Nexus and Securitize’s partnership to tokenize equity

03:54 – The significance of being a Nasdaq-listed firm with onchain shares

05:21 – What “natively tokenized” means vs wrapped or synthetic assets

07:11 – Why corporate participation matters for legitimacy and adoption

09:45 – How tokenization can expand liquidity, transparency, and access

11:17 – How Wall Street and major banks are now exploring stablecoins

12:46 – The path to adoption: regulation, revenue models, and marketplaces

14:32 – “Not all tokenization is created equal:” structural vs surface innovation

16:40 – Removing intermediaries: why smart contracts shift cost and trust

18:22 – The future of how AI and blockchain change corporate roles

20:59 – Why tokenized equities are the next evolution of capital markets

22:21 – Why FG Nexus chose Ethereum over other L1s

24:45 – Neutrality, decentralization, and Ethereum’s institutional alignment

26:09 – How FG Nexus fits into Ethereum’s ecosystem and future plans

27:46 – The Clarity Act and what it means for DeFi participation

29:57 – Challenges in tokenization: liquidity, interoperability & accounting gaps

31:48 – How blockchain will reshape corporate finance in 5–10 years

33:45 – “Rewriting Wall Street:” programmable finance for global markets

35:02 – The funniest and most interesting tokenization requests she’s received

36:57 – Closing thoughts: improving, not replacing, the existing financial system

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 8AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

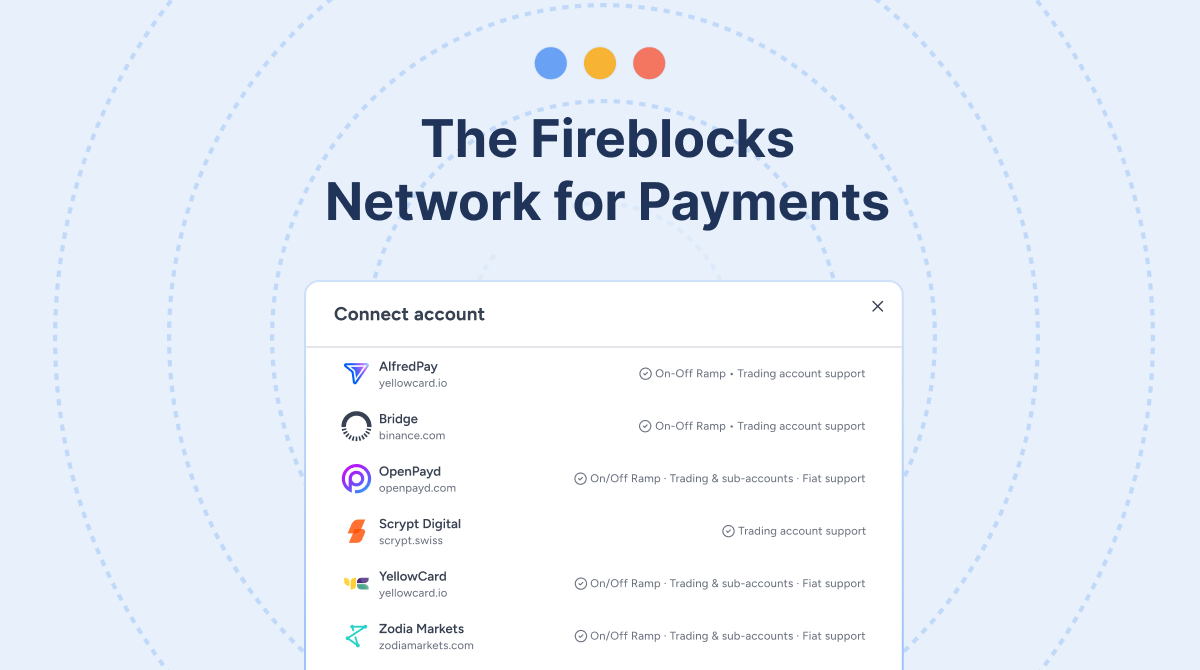

Scaling Stablecoin Infra with Fireblocks

This episode of Talking Tokens is brought to you by Fireblocks — the stablecoin infrastructure of choice for top global businesses, from Visa and Worldpay to Bridge and Revolut.

With over $100 billion in monthly stablecoin volume, Fireblocks powers stablecoin strategies at scale with infrastructure that enables PSPs, fintechs, remitters and banks to issue, move, hold, and manage stablecoins. And it’s all done securely, at scale, and with built-in compliance.

With Fireblocks, you get complete control to build your own stablecoin orchestration layer, create payment accounts, manage liquidity, and access on- and off-ramp into over 60 currencies — making it easier to build, scale, and expand your stablecoin business globally.

Learn more at fireblocks.com.

Money and people moves

Kraken acquires Small Exchange, a CFTC-regulated designated contract market, for $100M to expand derivatives footprint in the U.S. Market

CZ-linked YZi Labs leads $50 million round in stablecoin payment firm Better Payment Network (The Block)

Paxos Mistakenly Issues $300 Trillion of PayPal Stablecoin (Bloomberg)

Talking points for the road

Crypto-focused headlines or research that caught my eye…and should catch yours, too.

BlackRock’s crypto push deepens with a retooled product to serve stablecoin issuers (CNBC)

Ripple CEO Bashes Wall Street Bank Opposition of Fed Master Accounts for Crypto (CoinDesk)

Sony Wants Its Own Crypto Bank Too (Decrypt)

Crypto’s Hedge-Appeal Cracks as Gold Wins Big on Debasement Fear (Bloomberg)

Get involved and share the newsletter.

The more you refer, the more perks you could get!

And if you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.