Welcome back to Talking Tokens.

Was this forwarded to you? subscribe here.

Scaling Stablecoin Infra with Fireblocks

This episode of Talking Tokens is brought to you by Fireblocks — the stablecoin infrastructure of choice for top global businesses, from Visa and Worldpay to Bridge and Revolut.

With over $100 billion in monthly stablecoin volume, Fireblocks powers stablecoin strategies at scale with infrastructure that enables PSPs, fintechs, remitters and banks to issue, move, hold, and manage stablecoins. And it’s all done securely, at scale, and with built-in compliance.

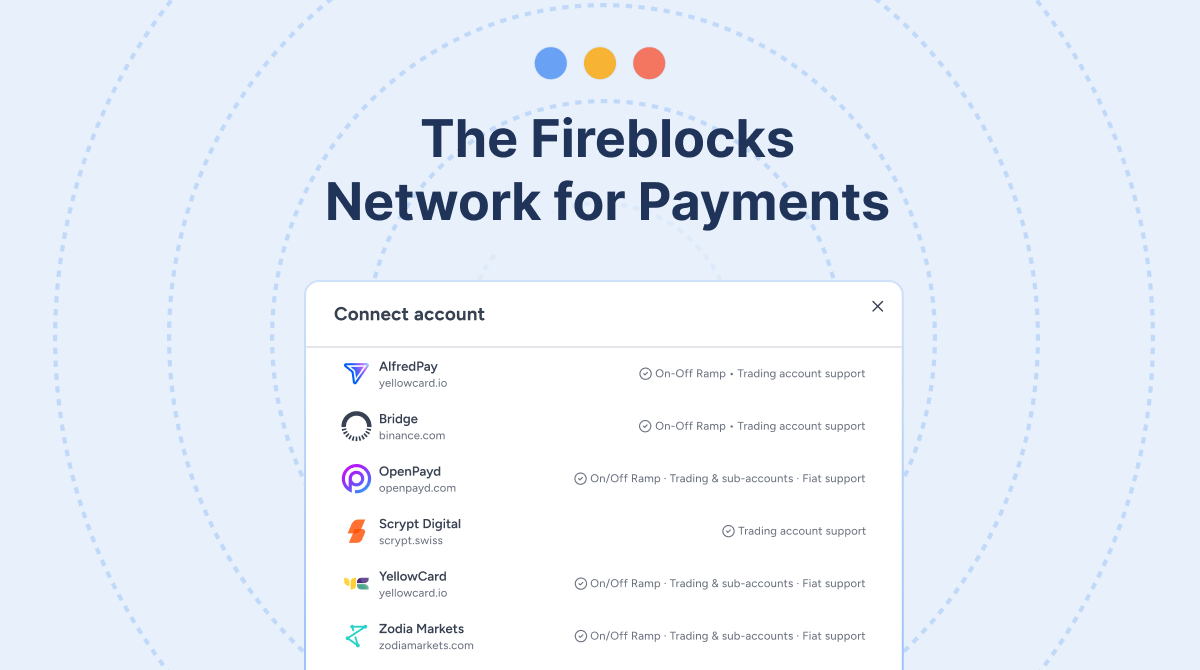

With Fireblocks, you get complete control to build your own stablecoin orchestration layer, create payment accounts, manage liquidity, and access on- and off-ramp into over 60 currencies — making it easier to build, scale, and expand your stablecoin business globally.

Learn more at fireblocks.com.

The latest Talking Tokens podcast 🎙️

For today’s Talking Tokens episode, I sat down with Carlos Domingo, Co-Founder and CEO of Securitize, following the company’s announcement that it will go public through a SPAC merger valuing it at $1.25 billion and the launch of a tokenized fund with BNY.

The conversation explores why Securitize chose to go public now, how the move fits into its broader mission of bringing real-world assets onchain, and what it means for the growing tokenization market. Carlos discusses the regulatory process behind going public, the importance of transparency and governance for institutional partners, and why he believes tokenization is entering a period of real adoption after years of experimentation.

We also cover Securitize’s new tokenized collateralized loan obligation (CLO) fund, the company’s partnership with BNY and Grove, and how these collaborations are paving the way for more yield-bearing products to come onchain.

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 8AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Sponsored by Securitize, the proven leader in tokenized funds, equities, and private markets. Discover more at securitize.io.

Money and people moves

Blockworks laid off its entire editorial staff as it sunsets its news outlet

Mastercard poised to acquire crypto startup Zerohash for nearly $2 billion, sources say (Fortune)

Marcus Mazur joins Ava Labs as a growth lead to support the Core app

Nemil Dalal, former Coinbase lead developer, departs the exchange after 7 years

Talking points for the road

Crypto-focused headlines or research that caught my eye…and should catch yours, too.

The Curious Case for Crypto Treasury Buybacks Takes Unique Turn (Bloomberg)

Hyperliquid and BNB Chain capture majority of L1 fees as Solana fades amid derivatives boom (The Block)

Wealth Managers Scramble to Add Crypto as UAE's Ultra-Rich Demand Digital Assets (CoinDesk)

Get involved and share the newsletter.

The more you refer, the more perks you could get!

And if you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.