Welcome back to Talking Tokens.

Was this forwarded to you? subscribe here.

Scaling Stablecoin Infra with Fireblocks

This episode of Talking Tokens is brought to you by Fireblocks — the stablecoin infrastructure of choice for top global businesses, from Visa and Worldpay to Bridge and Revolut.

With over $100 billion in monthly stablecoin volume, Fireblocks powers stablecoin strategies at scale with infrastructure that enables PSPs, fintechs, remitters and banks to issue, move, hold, and manage stablecoins. And it’s all done securely, at scale, and with built-in compliance.

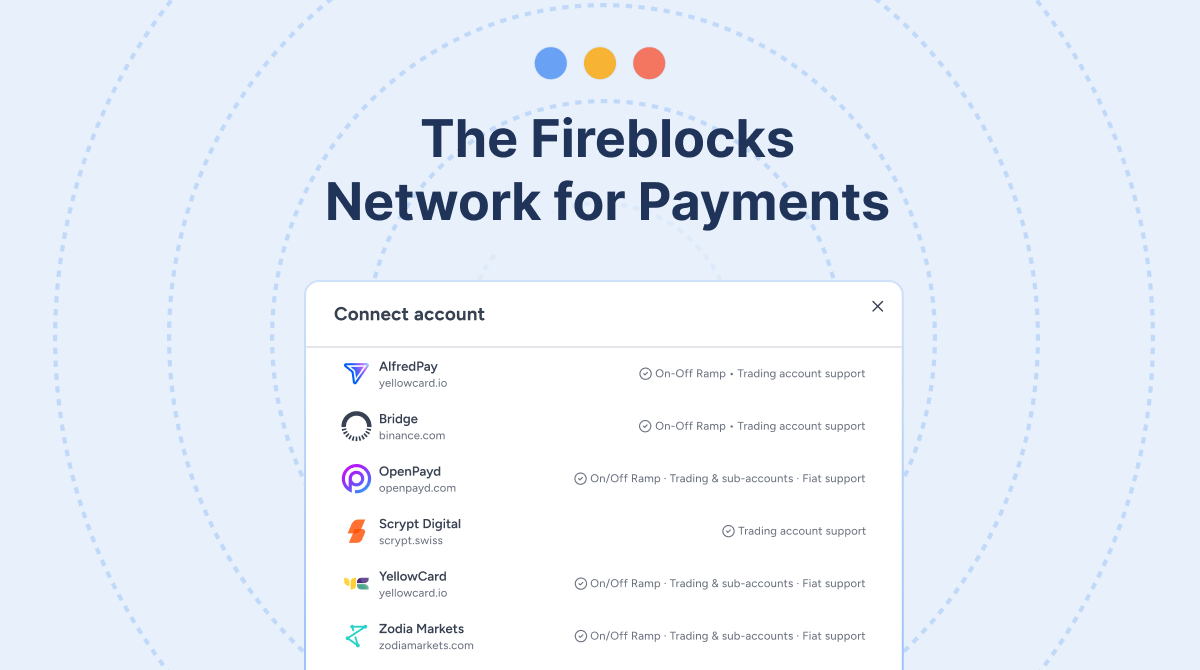

With Fireblocks, you get complete control to build your own stablecoin orchestration layer, create payment accounts, manage liquidity, and access on- and off-ramp into over 60 currencies — making it easier to build, scale, and expand your stablecoin business globally.

Learn more at fireblocks.com.

The latest Talking Tokens podcast 🎙️

For today’s Talking Tokens episode, I sat down with Vidor Gencel, Co-Founder of Solflare, shares the journey of building one of the most widely used crypto wallets in the Solana ecosystem.

This episode is a part of the Solana Sessions campaign that Token Relations and the Talking Tokens podcast are doing, diving into founders’ journeys and startups building on Solana. Check out the accompanying newsletter here.

Solflare has over 4 million users and manages billions in assets. He discusses how crypto’s cyclical nature shaped Solflare’s growth approach, emphasizing the importance to innovate even during bear markets. Vidor explains the crucial role of self-custody, how the wallet adapts to diverse user needs globally, and the importance of seamless user experience.

Hear about Solflare’s integration with Solana Mobile’s Seed Vault on Seeker and its flagship Saga device, the team’s focus on security with multi-wallet support, and plans for stablecoin yield and debit cards. He also shares insights on product design, lessons from both successes and challenges, and his optimistic outlook on Solana’s technical progress.

Talking Tokens episodes are released on Spotify and Apple Podcasts at 6AM EST or YouTube at 8AM EST every Tuesday and Thursday. Listen in!

Make sure to subscribe to keep up with the latest episodes. Feel free to leave a review and tell us your thoughts.

Money and people moves

Larry Florio joined Ethena Labs’ legal team

Adam Jacobs joined Plasma Foundation as head of global payments

Fireblocks and Circle Strategically Collaborate to Accelerate Stablecoin Adoption for Financial Institutions (Company Blog)

Coinbase acquihires Sensible to bring its leadership team internal

Derek Walkush joined Uniswap as a growth lead for Unichain

Binance teams with $1.6-trillion asset manager Franklin Templeton on tokenization push (The Block)

Talking points for the road

Crypto-focused headlines or research that caught my eye…and should catch yours, too.

BlackRock Exec Pitches Hyperliquid on Ethena’s Stablecoin Proposal (Decrypt)

Tesla bull Dan Ives now chairs a company hoarding a Sam Altman-linked cryptocurrency. He’s not the only big name to enter the treasury race (Fortune)

Saylor Model Struggles as Crypto Treasury Hype Turns to Doubt (Bloomberg)

Get involved and share the newsletter.

The more you refer, the more perks you could get!

And if you do (or don’t) like what you see, let me know by sending feedback to [email protected].

This product was built by Token Relations.